Unlocking Financial Insights Through Data Analytics

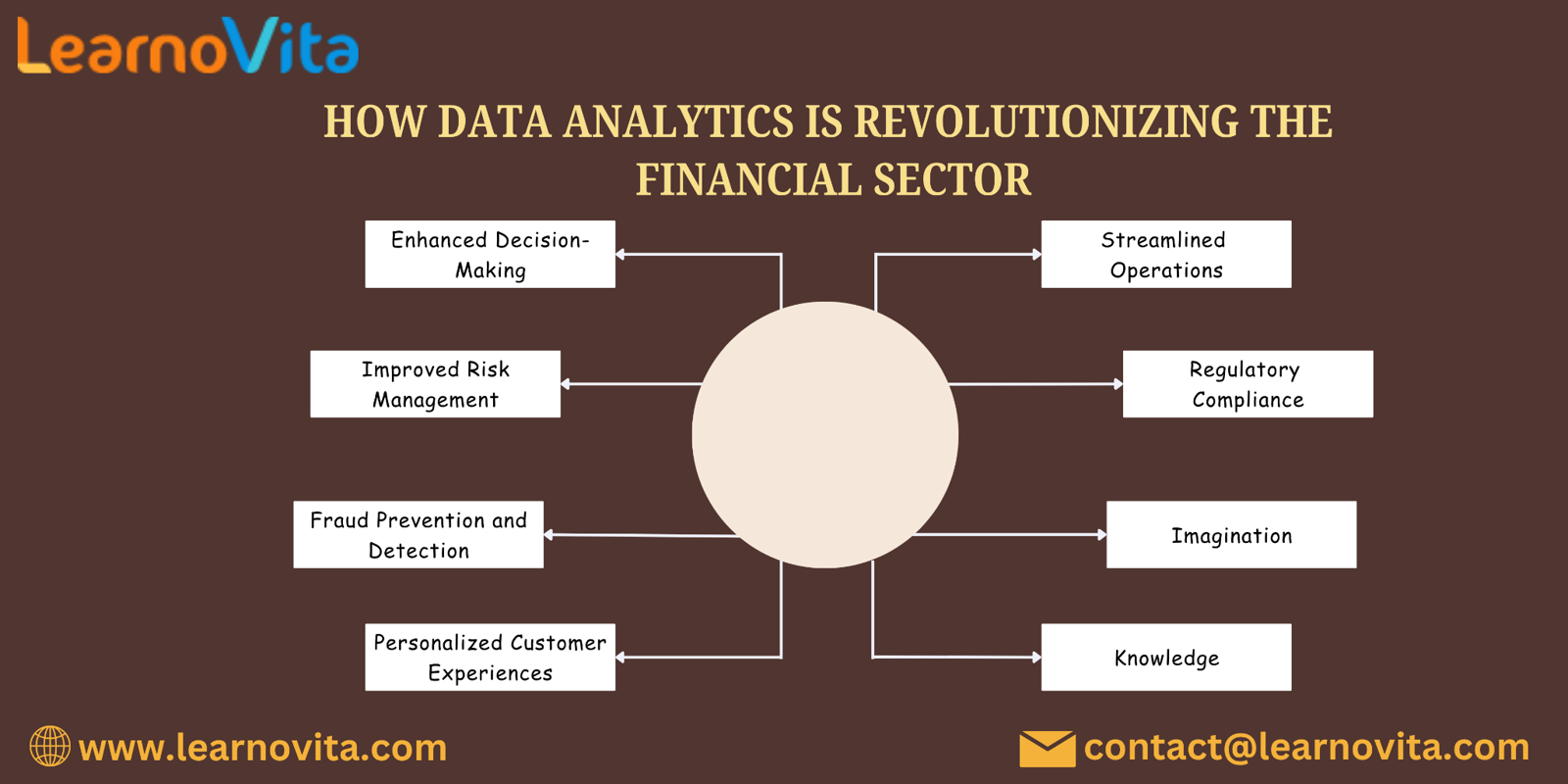

In an age where data reigns supreme, the financial sector stands at the forefront of leveraging data analytics to unlock valuable insights. As organizations navigate an increasingly complex landscape, the ability to transform raw data into actionable intelligence is more critical than ever. This blog delves into how data analytics is revolutionizing financial insights and driving strategic decision-making.

For those looking to enhance their skills, Data Analytics Course in Bangalore programs offer comprehensive education and job placement assistance, making it easier to master this tool and advance your career.

1. The Power of Data-Driven Insights

Data analytics empowers financial professionals to make informed decisions based on empirical evidence rather than intuition alone. By analyzing vast amounts of financial data, organizations can uncover hidden trends, patterns, and correlations that inform strategic initiatives. This data-driven approach enhances accuracy and reduces the risk of costly mistakes.

2. Understanding Customer Behavior

One of the most significant benefits of data analytics is the ability to gain deep insights into customer behavior. By examining transaction histories, preferences, and demographics, financial institutions can tailor their products and services to meet individual needs. This personalized approach not only enhances customer satisfaction but also fosters loyalty, driving long-term relationships.

3. Enhancing Risk Management

Effective risk management is essential in finance. Data analytics allows organizations to assess risks comprehensively by analyzing historical data and current market conditions. Predictive analytics can identify potential vulnerabilities, enabling institutions to develop proactive strategies that mitigate risks before they escalate.

4. Streamlining Operations

Operational efficiency is key to maintaining a competitive edge. Data analytics helps identify inefficiencies in processes and workflows, allowing organizations to streamline operations. By automating routine tasks and optimizing resource allocation, financial institutions can reduce costs and enhance productivity, ultimately benefiting their clients.

5. Real-Time Decision-Making

In the fast-paced financial landscape, the ability to make real-time decisions is crucial. Data analytics provides insights that can be accessed instantly, enabling organizations to respond swiftly to market changes. This agility is vital for capitalizing on fleeting opportunities and managing risks effectively.

With the aid of Data Analytics Certification Course programs, which offer comprehensive training and job placement support to anyone looking to develop their talents, it’s easier to learn this tool and advance your career.

6. Optimizing Investment Strategies

Investment success relies on informed decision-making. Data analytics equips financial analysts with the tools to evaluate investment opportunities comprehensively. By analyzing market trends, asset performance, and economic indicators, organizations can develop strategies that maximize returns while minimizing risks.

7. Regulatory Compliance and Reporting

Compliance with regulatory requirements is a significant challenge for financial institutions. Data analytics simplifies compliance tracking and reporting, ensuring that organizations adhere to regulations efficiently. By automating data collection and analysis, institutions can minimize the risk of penalties and maintain transparency.

8. Gaining Competitive Insights

In a competitive financial landscape, understanding market dynamics is essential. Data analytics provides insights into competitor performance, market trends, and customer sentiment. By leveraging these insights, organizations can adapt their strategies and position themselves favorably in the marketplace.

Conclusion

Unlocking financial insights through data analytics is no longer a luxury; it is a necessity. As financial institutions continue to harness the power of data, they are better equipped to navigate challenges, seize opportunities, and deliver exceptional value to their customers. In this data-driven era, embracing analytics is the key to thriving in the complex world of finance.

Comments

Post a Comment